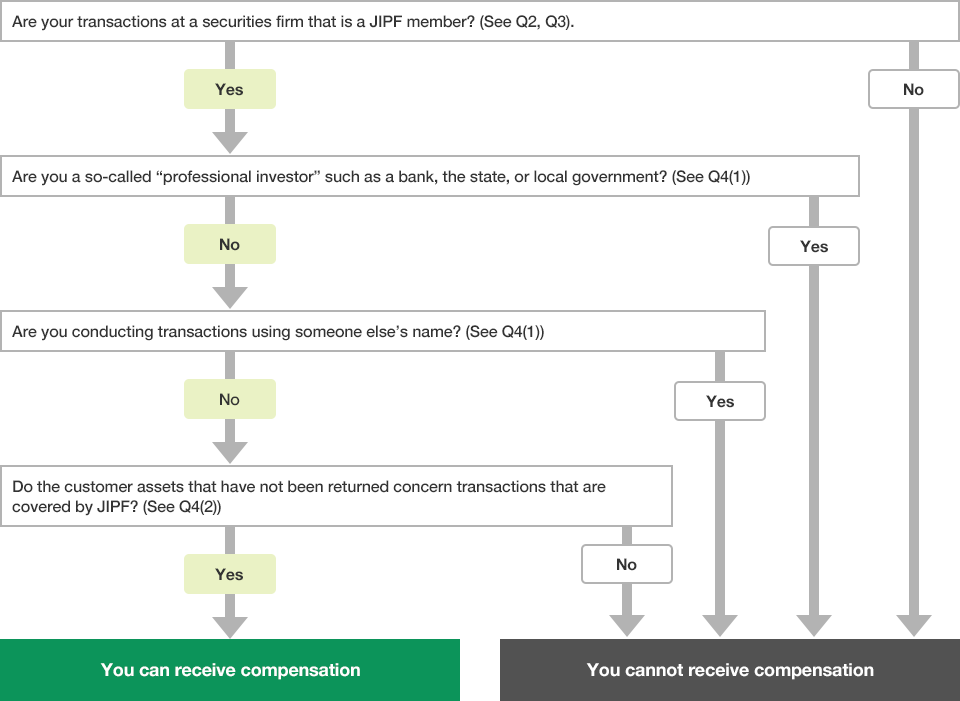

Please note that there are cases where money and securities are not covered by JIPF, even though they are entrusted to securities firms, depending on the customer attributes and transaction contents.

Customers covered by JIPF are those customers of JIPF member securities firms who are not so-called "professional investors" such as financial institutions, the state, and local governments. (Legally, these customers who are covered are referred to as "General Customers").

*) Even for General Customers, assets of customers executing transactions in the name of others are excluded from the range of compensation . Also, officers and other executives of the bankrupt security firm are not included among the customers eligible for compensation.

The money, securities, and other customer assets eligible for compensation are limited to those entrusted for Type I Financial Instruments Business transactions conducted by securities firms regarding the securities-related business. Even among transactions conducted by the same securities firm, customer assets related to foreign exchange margin transactions (FX transactions) and other transactions that are not included in the securities-related business are not covered by JIPF.

*) Even among transactions eligible for compensation, shares, corporate bonds and other securities, issued by the bankrupt securities firm are excluded from the range of compensation. (See Q6).

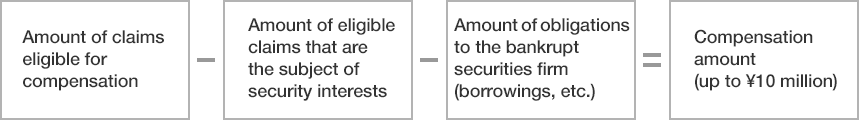

Compensation Amount Calculation Method